- India

- International

Why the Gold rush: Record $150mn seized in 10 months

10% import duty, annual demand pegged at 840 tonnes, low prosecution rate make gold smuggling a lucrative option once again.

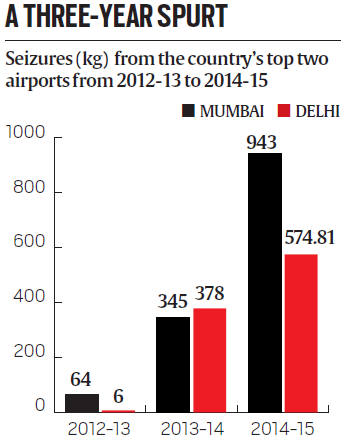

This spurt since 2012-13 is most visible in seizure figures over the last three years at India’s two busiest international airports handling roughly 30,000 international passengers each every day — 64 kg to 943 kg in Mumbai and 6 kg to 574.81 kg in Delhi.

This spurt since 2012-13 is most visible in seizure figures over the last three years at India’s two busiest international airports handling roughly 30,000 international passengers each every day — 64 kg to 943 kg in Mumbai and 6 kg to 574.81 kg in Delhi.

In Mumbai Customs lingo, ‘Dhanalakshmi’ or ‘Kuber’ aren’t gods their officers propitiate or horses they bet on at the city’s famous Mahalaxmi racecourse. ‘Dhanalakshmi’ is the code for the Emirates flight EK500 from Dubai to Mumbai while ‘Kuber’ refers to Air India’s AI 984 which flies the same route. Officials say these are the flights used most often by gold smugglers.

According to Customs officials, ‘Dhanalakshmi’ alone accounted for 72kg of seizures in 2014-15 — almost 8 per cent of the 943kg seized at Mumbai’s Chhatrapati Shivaji International Airport, a record for the last three years and a 173% hike from the previous year.

According to Customs officials, ‘Dhanalakshmi’ alone accounted for 72kg of seizures in 2014-15 — almost 8 per cent of the 943kg seized at Mumbai’s Chhatrapati Shivaji International Airport, a record for the last three years and a 173% hike from the previous year.

But countrywide figures show that Mumbai is just one of the many landing grounds for these smugglers. Officials and industry insiders attribute this spike to a “high” import duty of 10 per cent from 2013, a booming demand pegged by the World Gold Council at around 840 tonnes in 2014 – 191.7 tonnes in the first quarter of fiscal 2015 alone, up 15 per cent from the same period last year — and a low prosecution rate of those caught smuggling gold.

Read: From labourer to airlines insider, the changing face of the gold smuggler

This spurt since 2012-13 is most visible in seizure figures over the last three years at India’s two busiest international airports handling roughly 30,000 international passengers each every day — 64 kg to 943 kg in Mumbai and 6 kg to 574.81 kg in Delhi (see bar graph).

Now, consider these figures obtained from official records and the World Gold Council:

* There were 3,412 incidents of gold seizures at airports across the country in the first 10 months of the financial year 2014-15 — it was 2,450 for the entire previous year, Minister of State for Commerce Nirmala Sitharaman informed Lok Sabha in March.

* The value of gold seized in the first 10 months of 2014-15 was about US$150mn, up from US$110mn in the same period of 2013-14 and US$7mn in 2011-12.

* Even this is just a fraction of the 175 tonnes, worth around US$7bn, which the World Gold Council estimates was brought illegally into the country in 2014-15 alone.

May 13: 2 kg gold bars tied to the soles, seized in Mumbai.

May 13: 2 kg gold bars tied to the soles, seized in Mumbai.

So much so, that at a time when the NDA government announced a monetisation scheme in this Budget to unlock the value of a part of the 22,000 tonnes of gold (US$1trn) in private hands, a big chunk lies with its own Customs departments – over 2,000 kg seized over the past 10 years (see “Costly Stock”).

“These are people operating in an organised way. We have busted five Mumbai gangs in the past year alone,” Milind Lanjewar, additional commissioner of Air Intelligence Unit, Mumbai Airport Customs, told The Indian Express.

“The big fish are those who were earlier involved in ‘airport smuggling’ of gutkha, memory cards, cosmetics and electronic goods. Once the import duty shot up in 2013, they were attracted to the high premium attached to gold-smuggling,” he added.

March 20: 40 gold pieces (Rs14.24 lakh) in liquor bottles in Mumbai.

March 20: 40 gold pieces (Rs14.24 lakh) in liquor bottles in Mumbai.

According to Customs rules, Indian men who have lived abroad for over a year are allowed to bring jewellery duty-free upto an aggregate value of Rs 10,000 each, while women are allowed a duty-free limit of Rs 20,000. The rules also allow for gold to be imported otherwise as part of baggage or as unaccompanied baggage provided the duty is paid in foreign currency.

Blame it on duty, duty-free

Industry experts attribute the spurt in gold smuggling to the rise in duty two years ago, and the RBI’s 80:20 import-export norm that was in force till November last year.

As India’s current account deficit rose to a 20-year high of 4.2 per cent of the GDP in 2011-12 and the rupee fell sharply, the government increased the import duty on gold in 2013 — from four per cent to a record 10 per cent.

Imports fell sharply but the price difference between Indian gold prices and those in duty-free havens such as Dubai led to an increase in smuggling to feed the demand for gold.

“Under the 80:20 scheme, importers were allowed to import gold only if 20% of the lot was exported,” said Ketan Shroff, spokesperson, India Bullion and Jewellery Association.

Vipul Shah, chairman of Gems and Jewellery Export Promotion Council, said the industry has been “constantly urging the government to lower the import duty on gold”. “The current import duty coupled with high gold consumption in India is encouraging smuggling. The government should bring down the import duty and probably look at other ways of curtailing imports,” said Shah.

Vipul Shah, chairman of Gems and Jewellery Export Promotion Council, said the industry has been “constantly urging the government to lower the import duty on gold”. “The current import duty coupled with high gold consumption in India is encouraging smuggling. The government should bring down the import duty and probably look at other ways of curtailing imports,” said Shah.

After arrests, the long delay

The other main factor encouraging gold smuggling, say Customs officials and lawyers whom The Indian Express spoke to, was the low prosecution rates and the delay in the legal process.

“Typically, once a gold smuggler is arrested, it takes at least six months for the Customs to complete its investigation and issue a showcause notice. Thereafter, the authority takes another six months to adjudicate the case — usually, prosecution is launched only after a year,” said A P S Suri, Commissioner of Customs, Mumbai airport.

“Sometimes the process is further delayed by six months or a year if the accused moves court against the showcause notice or adjudication order of the Customs,” said a senior Customs official at the Hyderabad airport.

* In Mumbai alone, the total number of pending prosecution cases in various courts up to April 2015 is 468. “These 468 include cases dating back to 10 years and do not include cases booked by us in the last two years,” said Lanjewar.

* In Ahmedabad, 50 cases were sent for prosecution in 2014-15, but not one of them booked in the last two years.

* In Delhi, 500 cases are pending from the last 10 years.

“We produce offenders before the court within 24 hours. Yet, none of the cases that resulted in nearly 1,000kg of gold seizures in the last one year has reached the prosecution stage,” said a Customs official in Mumbai, adding they booked 1,146 cases and arrested 260 smugglers in 2014-15.

According to law, once a flier is caught with undeclared gold, he is arrested and almost immediately granted bail if the seizure value is below Rs 1 crore — about 3.85kg.

“All that the offender has to do is pay duty at a penal rate of 20 per cent and a fine of 36 per cent of the value of the gold. But those caught smuggling gold worth over Rs 1 crore require bail from a lower court,” said a lawyer, who is representing a client in one such case.

Take the case of the restaurant owner from Dubai waiting outside the interrogation room in Mumbai airport. He was the largest single catch in the last six months with a lookout notice issued at Delhi airport after his name cropped up in several investigations — this time he was caught with 5kg of gold and yet, prosecution is expected to take at least two years. Now out on bail, he wants officials to return his passport that was seized during arrest.

What to do with all the gold

All of this means that Customs wings at airports across the country face a unique problem: what to do with the gold they have seized. Officials admit that the disposal procedure has made it difficult for them to get rid of seized gold, some of which has been in their custody for over 10 years now. “There is too much gold with us and it is a headache. I am sure after the central bank and temple trusts, we have the highest gold in our vault,” said Lanjewar, of Mumbai Customs.

On April 18, a government audit in Tiruchirapalli revealed that 15kg of gold were missing from the vaults of the Excise and Customs office at the airport — the CBI has now launched an investigation.

“It can happen at any airport. The process of disposal of seized gold is very slow and I don’t want to share the amount of gold we have in our vaults at Hyderabad,” said a Customs official at Hyderabad airport.

According to officials, in cases pertaining to smuggling of gold below Rs 20 lakh (770g at current prices), the gold is released to the owner after charging the duty and penalty. Seized gold worth over Rs 20 lakh requires a magistrate to check the inventory, certify the metal and make a panchnama of the seizure before it can be disposed.

Under norms, this process cannot be completed without the consent of the passengers from whom the gold was seized. Once that is obtained, the gold is sent to RBI, which turns the Dubai-marked or Swiss-marked gold into standard Indian gold to meet quality norms. It is then sold by State Bank of India in an open, online auction.

“Most passengers do not consent to disposing of the gold, so we are stuck with most of it. There is a provision that if the passenger challenges our seizure and wins, either the seized gold or an equivalent amount has to be returned. Usually, the passengers want the gold back. That’s why we are stuck,” said Mumbai Customs’ Lanjewar.

Apr 19: Latest News

- 01

- 02

- 03

- 04

- 05