With yesterday’s FOMC brouhaha now out of the way for another month, it’s an apposite time to consider the VIX for the ultimate barometer of risk, and perhaps the best analogy here is of a guitar string, with the sound wave from each plucked note, dying away as the vibrations subside.

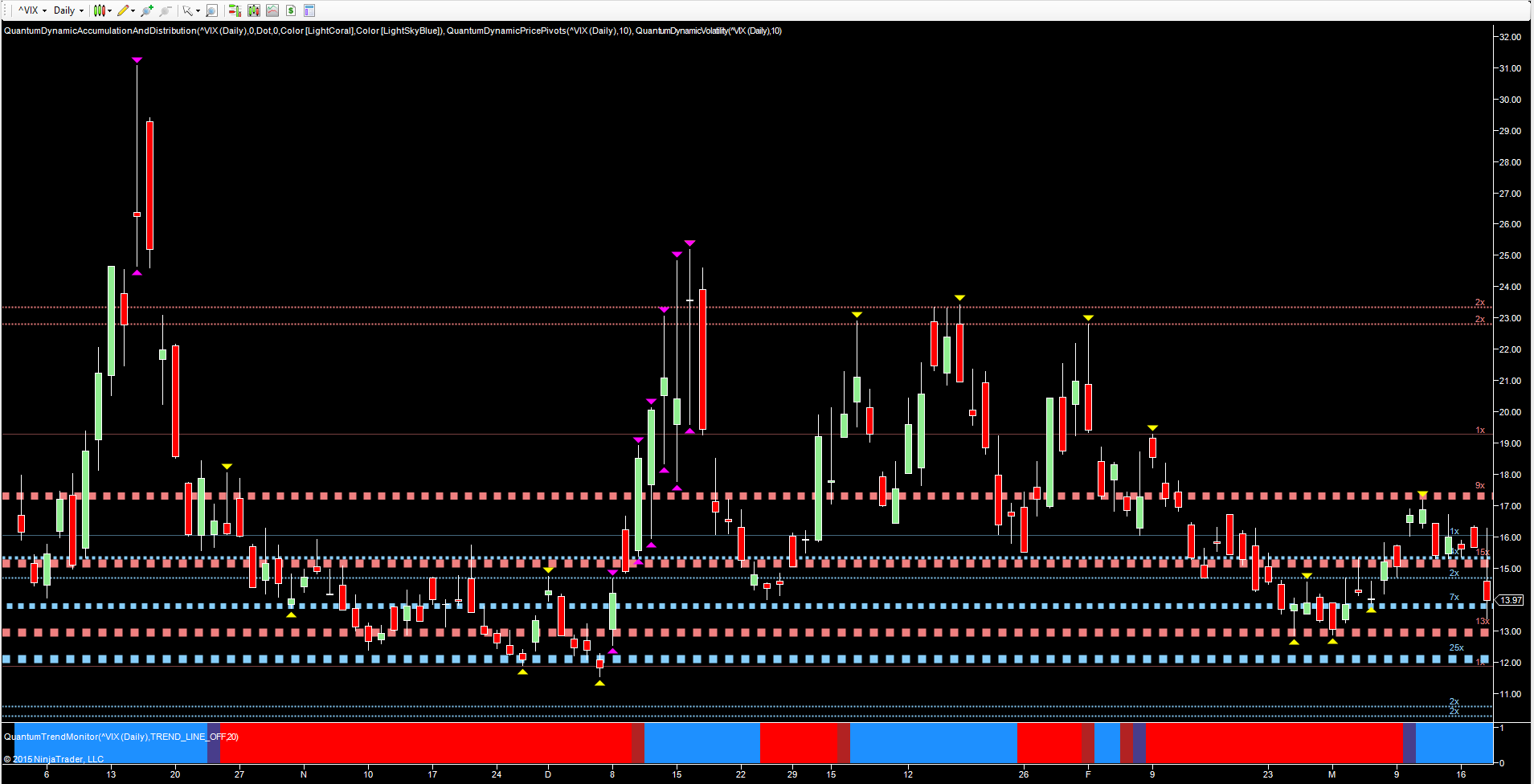

This has been the price action for the VIX over the last few months, with a sudden volatile move higher, then duly calming as the markets recover. This was the response in November which saw the index touch an intraday high of 31.06 before returning to test the strong platform of support in place in the 12 region.

Since then, we have seen this pattern repeated several times in 2015, but each time failing to develop into any longer trend, with the index reverting lower on each occasion after the initial shock.

Since late February and early March the index has been trading in a relatively narrow range, testing the deep resistance now in place at 17.25, with the equally well developed support platform at 13.00 maintaining this price channel, with yesterday’s perceived dovish comments from the FOMC driving equities higher and the VIX lower.

Moving forward, should equities duly break out into new high ground, then the support regions at the 13 and 12 price points will need to be breached, with any move through the second of these levels then opening the way towards single figures as fear subsides, complacency sets in and the sun continues to shine brightly for equities.