A finance company established to provide loans to homeowners as part of the government’s flagship energy efficiency programme has warned it may consider voluntary liquidation at a board meeting next week.

The Green Deal Finance Company, set up with more than £240m of public money, has run into trouble partly because it has been unable to convince the state-owned Green Investment Bank to continue funding.

The GDFC said talks were continuing with the bank and the company, which is backed by the big six energy suppliers such as SSE and British Gas, remained optimistic it would be able to obtain funding for the future.

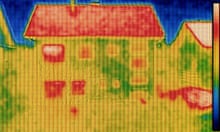

The wider green deal scheme, which encourages householders to fit more efficient boilers and install better insulation, has been dogged by problems and failed to meet its targets.

A letter sent to the lending company’s investors on 22 September warned of liquidation but a spokesman insisted this was just “good corporate governance and risk management” by the chief executive, Mark Bayley.

“It is business as usual at the moment and this is a story of growth. We are now agreeing up to 1.2m green deal [financing] plans a week and are looking at how to fund future growth for 2015 and 2016.

“[Voluntary liquidation] is very unlikely and just one of a range of scenarios. We have strong support from investors and are still right in the middle of discussions with the Green Investment Bank [GIB],” added the spokesman.

But the letter from Bayley reveals that the not-for-profit GDFC has warned Amber Rudd, a minister at the Department of Energy & Climate Change (DECC) about the need for more funding.

“We advised that the GDFC could not continue without funding and that this funding could not come from any source other than government [either GIB or DECC],” said Bayley’s letter which was first published by the website BusinessGreen.

The company spokesman confirmed a document had been prepared and sent to backers but insisted it was confidential so could not be made available.

The Green Investment Bank said it could not comment.

Comments (…)

Sign in or create your Guardian account to join the discussion