What the world's financial markets are worth

12th February 2015 09:06

by Lee Wild from interactive investor

Share on

Global financial markets deal in mind-boggling numbers. We know that. But just what are all the world's financial assets worth? What is it as a percentage of global GDP? How have market fluctuations affect stockmarket capitalisations? Where's the hot money going?

With all the answers is Deutsche Bank’s global strategist Sanjeev Sanyal who's just published the investment bank's fourth annual edition of "Mapping the World's Financial Markets".

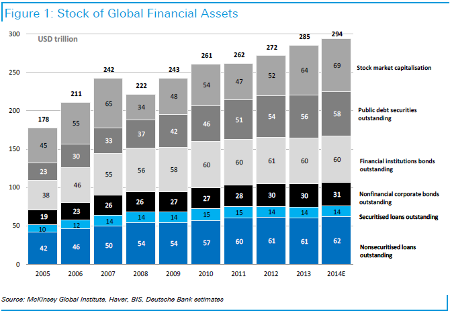

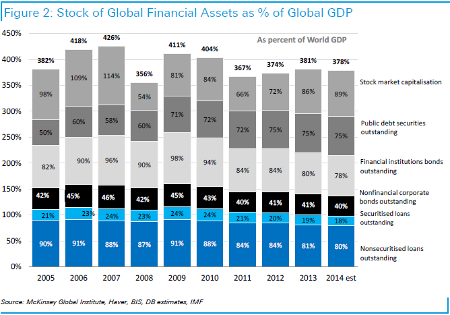

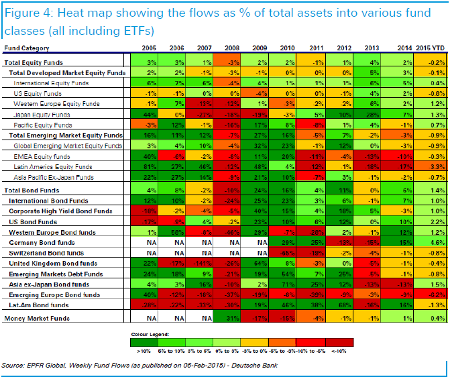

The results are best viewed in the charts (below), but, in summary, the stock of the world's financial assets continued to grow in 2014, although dipped as a percentage of global GDP. Fund flows to developed country equity and bond funds exceeded those to emerging markets in 2014 and, despite the massive increase in financial assets, volume of turnover in equity and bond markets remained below the 2011 peak.

Deutsche Bank: To the extent possible, we have tried to maintain consistency but readers should treat this information as no more than an honest attempt to grasp the scales of magnitude of the world's financial markets, and should read the notes accompanying the charts and tables.

Of note here is the collapse in stockmarket capitalisation in 2008 and subsequent recovery by 2014. In that time, the value of global stockmarkets has more than doubled. It's also interesting to see the steady growth in the global market for public debt securities both before and after the credit crunch.

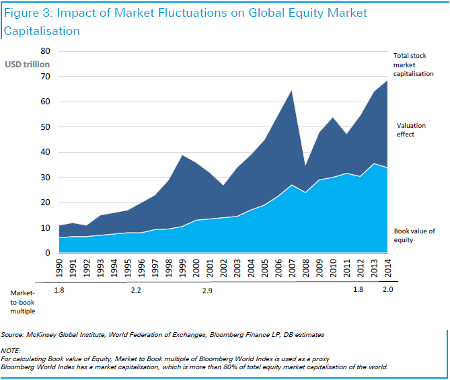

It's clear that investors have been prepared to pay a larger premium to book value for equities during the past two years. See how the premium evaporated in the aftermath of the financial crisis.

Cash was king in 2008 as investors exited pretty much everything and piled the proceeds into money market funds. A year later and it was emerging market equity funds and UK bond funds that were in vogue. Now, the pendulum has swung back in favour of developed country equity and bond funds.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.