- News

- Business News

- India Business News

- National Spot Exchange may face tax, laundering probes

Trending

This story is from August 16, 2013

National Spot Exchange may face tax, laundering probes

The government is likely to order a multi-agency probe into the National Spot Exchange (NSEL) fiasco, besides getting central agencies such as Food Corporation of India and the Central Warehousing Corporation to take stock of the commodities lying in warehouses across the country.

NEW DELHI: The government is likely to order a multi-agency probe into the National Spot Exchange (NSEL) fiasco, besides getting central agencies such as Food Corporation of India and the Central Warehousing Corporation to take stock of the commodities lying in warehouses across the country.

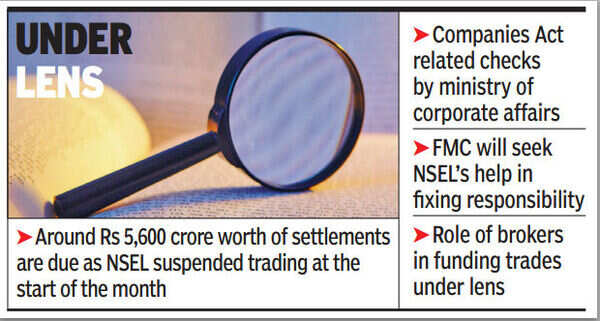

Nearly Rs 5,600 crore worth of settlements are due as the exchange suspended trading at the start of the month. The exchange was virtually unregulated as the ministry of consumer affairs sat over a report alleging irregularities for over a year.

The consumer affairs ministry, which was dealing with the issue till last week, is expected to rope in other agencies after the Forward Markets Commission (FMC) recommended such an action in its report earlier this week.

Government officials told TOI that FMC, the Mumbai-based agency, has suggested that there should be a check on some of the borrowers as there have been complaints about the issue. As a result, the finance ministry will be asked to designate an agency to investigate into the issue, including those related to tax and money laundering.

When asked, a finance ministry official said: "We have not ordered an investigation yet. Not yet."

Similarly, the corporate affairs ministry is being asked to find out if the exchange functioning was in line with the provisions of the Companies Act. Even brokers are suspected to have funded investments of some of the investors.

Separately, FMC is also going to seek NSEL's help in fixing responsibility and is looking at the risk management system as the settlement guarantee fund, meant to safeguard investor interest, has plunged from almost Rs 840 crore to Rs 5 crore now.

The food ministry has been approached to get agencies such as FCI to look at the stocks in warehouses as FMC has detected some inconsistencies and there have been complaints from those who traded on NSEL. "An independent verification will only help and provide confidence to the system," said a consumer affairs ministry official.

For instance, data for July 31 released by NSEL had showed that Abans Commodities had farm grade Jeera in Gujarat while Aastha Minmet and Juggernaut Projects had steel bars in Andhra Pradesh.

On August 6, documents show only Juggernaut had the steel bars and Asstha's name was missing.

Similarly, there was no mention of Abans. When contacted, a spokesperson for NSEL said Abans settled its entire liability last week while Aastha Minmet and Juggernaut are group companies and there liabilities have been clubbed.

Nearly Rs 5,600 crore worth of settlements are due as the exchange suspended trading at the start of the month. The exchange was virtually unregulated as the ministry of consumer affairs sat over a report alleging irregularities for over a year.

The consumer affairs ministry, which was dealing with the issue till last week, is expected to rope in other agencies after the Forward Markets Commission (FMC) recommended such an action in its report earlier this week.

Government officials told TOI that FMC, the Mumbai-based agency, has suggested that there should be a check on some of the borrowers as there have been complaints about the issue. As a result, the finance ministry will be asked to designate an agency to investigate into the issue, including those related to tax and money laundering.

When asked, a finance ministry official said: "We have not ordered an investigation yet. Not yet."

Similarly, the corporate affairs ministry is being asked to find out if the exchange functioning was in line with the provisions of the Companies Act. Even brokers are suspected to have funded investments of some of the investors.

Separately, FMC is also going to seek NSEL's help in fixing responsibility and is looking at the risk management system as the settlement guarantee fund, meant to safeguard investor interest, has plunged from almost Rs 840 crore to Rs 5 crore now.

The food ministry has been approached to get agencies such as FCI to look at the stocks in warehouses as FMC has detected some inconsistencies and there have been complaints from those who traded on NSEL. "An independent verification will only help and provide confidence to the system," said a consumer affairs ministry official.

For instance, data for July 31 released by NSEL had showed that Abans Commodities had farm grade Jeera in Gujarat while Aastha Minmet and Juggernaut Projects had steel bars in Andhra Pradesh.

On August 6, documents show only Juggernaut had the steel bars and Asstha's name was missing.

Similarly, there was no mention of Abans. When contacted, a spokesperson for NSEL said Abans settled its entire liability last week while Aastha Minmet and Juggernaut are group companies and there liabilities have been clubbed.

End of Article

FOLLOW US ON SOCIAL MEDIA